What Are ESG Ratings?

ESG scores can be used to measure a company’s ability to operate sustainably and its long-term resilience regarding Environmental, Social, and Governance factors. These factors typically have economic impacts and are often not included in traditional market analysis.

Why Do Traders Care About ESG Scores?

Investors can analyze a company’s ESG score to evaluate performance, identify potential trading opportunities, assess possible growth prospects, and gauge risks. If a company can effectively address ESG issues, it is more likely to have stronger resilience and sustainable operational capabilities.

- Gain in-depth insights into a company’s ESG goals.

- Go long or short on stock CFDs using our ESG ratings.

- Track a company’s ESG score to monitor changes in its sustainable operational capabilities.

- Make informed decisions based on a company’s ESG ranking.

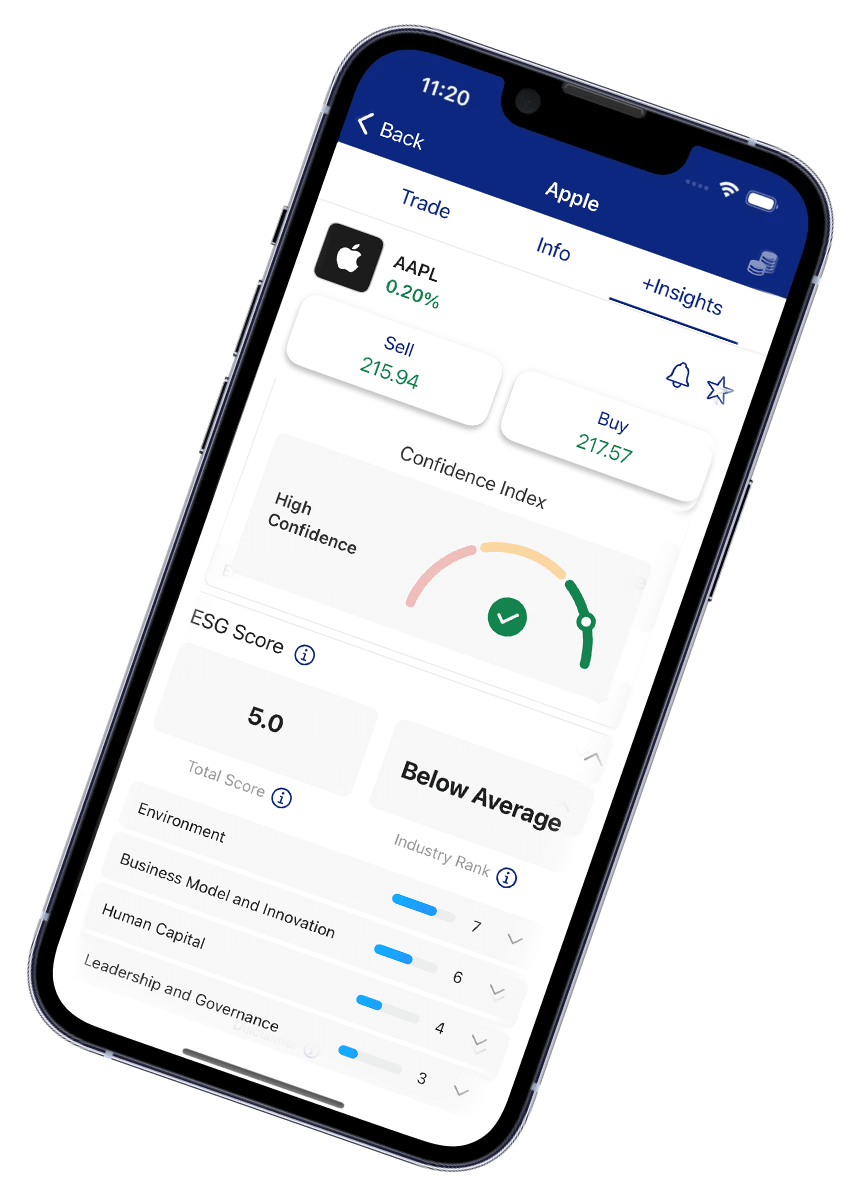

Understand Intuitive ESG Ratings with Global Trade

Gain insights into a company’s sustainable operational capabilities and ethical performance through our easy-to-use ESG ratings for a variety of stocks.

Overall ESG Score

The average score of all sub-categories, excluding the main category scores.

Main Category Score

The average score of relevant sub-categories.

Total Score

Each ESG score is rated on a scale of 1 (lowest) to 10 (highest).

Industry Ranking

Leader, Above Average, Average, Below Average, Laggard.